Best Credit Card Processors for Small Businesses: 2026 Price Guide & Fee Comparison (U.S.)

Originally published on July 2, 2025. Last updated on February 22, 2026.

Finding the best credit card processor for your small business does not just come down to shiny software features. It is fundamentally about transparent pricing. Every time a customer swipes, dips, or types in their credit card, your business loses a fraction of that sale to processing fees. On average, small businesses pay between 1.5% and 3.5% per transaction in credit card processing fees. However, that number can climb significantly higher if you are stuck in the wrong pricing model.

From flat-rate simplicity to interchange-plus savings, this 2026 price guide breaks down credit card processing fees for the top U.S. providers based on different business types. We will explore how different pricing structures work and help you uncover hidden fees that might be draining your monthly revenue.

Whether you are a freelancer sending out occasional invoices, a bustling retail shop using a full Point of Sale (POS) system, or a subscription-based business billing customers monthly, we will help you find the lowest-cost payment processor that perfectly fits your model.

Want more tailored recommendations? Check out our full Credit Card Processor Comparison by Business Type for best-in-class picks by industry and payment model.

The True Cost of Processing: Where Does Your Money Go?

Before you can choose the cheapest processor, it helps to understand exactly who gets paid when a transaction occurs. The fee you see on your statement is typically a combination of three different costs:

Interchange Fees: These are non-negotiable fees paid to the cardholder's issuing bank. They make up the largest portion of your costs. For example, Visa and Mastercard interchange fees generally range from 1.15% to 3.15% depending on the card type.

Assessment Fees: These are small fees paid directly to the credit card networks (like Visa, Mastercard, or Discover) for using their infrastructure. They usually sit around 0.14% to 0.165% per transaction.

Processor Markup: This is the only negotiable part of the equation. It is the fee your payment provider (like Square, Stripe, or Helcim) charges for facilitating the transaction and providing you with software tools.

In 2026, the way your payment processor calculates their specific markup will dictate your entire pricing model.

Pricing Models Explained

Choosing the right pricing structure is one of the most effective ways to control your costs. Each model offers different benefits, so the best one for you depends entirely on your sales volume and business needs. Below is a breakdown of the different pricing models typically used by providers.

1. Flat-Rate Pricing

With this model, you pay a fixed percentage plus a small flat fee per transaction, no matter what type of card the customer uses.

How It Works: A provider might charge a flat 2.9% plus 30 cents for every online sale.

Best For: Freelancers, low-volume businesses, and startups. It is incredibly easy to predict your costs, but it can become expensive once your sales volume grows.

2. Interchange-Plus Pricing

This is widely considered the most transparent model available. You pay the direct cost of the interchange fee set by the card networks plus a fixed, transparent markup from your processor.

How It Works: If a customer uses a basic debit card with a low interchange rate, your processing fee goes down. The processor only takes their stated markup (for example, 0.40% plus 8 cents).

Best For: B2B companies, mid-sized retailers, and high-volume businesses processing over $5,000 a month.

3. Subscription (Membership) Pricing

Also known as direct-cost pricing, this model involves a fixed monthly membership fee in exchange for zero percentage markup on the transaction.

How It Works: You pay the wholesale interchange rate plus a few cents per transaction, but you must pay a monthly fee (e.g., $99 a month) to access the platform.

Best For: Established, high-volume businesses processing over $10,000 or $20,000 a month where the transaction savings outweigh the monthly subscription cost.

4. Tiered Pricing

Tiered plans group transactions into different categories like qualified, mid-qualified, and non-qualified.

How It Works: Basic debit cards might get a low qualified rate, while corporate rewards cards get bumped to an expensive non-qualified rate.

Best For: Generally, this model is not recommended for small businesses as it lacks transparency and can lead to unexpectedly high statements.

| Model | How It Works | Best For |

|---|---|---|

| Flat Rate | Fixed % + fee per transaction. Easy to predict. | Freelancers, low-volume businesses |

| Tiered Pricing | Rates vary based on transaction “type” (qualified/non-qualified). Can be unclear. | Older POS systems, resellers |

| Interchange-Plus | Real card network fee + processor markup. Very transparent. | B2B, high-volume businesses |

| Custom / Subscription | Monthly platform fee + 0% markup (e.g. Stax, Toast) | High-volume or specialized POS users |

Best Payment Processors by Business Type

Finding the right fit means looking at both your monthly processing volume and the tools your specific industry requires. Here is our breakdown of the best credit card processors in 2026.

| Business Type | Processor | Pricing Model | Transaction Fees | Monthly Fee | Why It’s the Best Fit |

|---|---|---|---|---|---|

| Freelancers / Consultants | Square | Flat Rate | 2.6% + 10¢ (in-person) 2.9% + 30¢ (online) |

$0 | Best credit card processor for freelancers with no monthly fees and invoice support |

| Online Stores / SaaS | Stripe | Flat Rate / Custom | 2.9% + 30¢ 3.9% for international cards |

$0 | Best processor for online businesses with recurring billing and global reach |

| Service-Based Businesses | Square | Flat Rate | Same as above | $0 | Best payment processor for contractors using mobile payments |

| Restaurants (POS) | Toast | Custom / Quote | Avg 2.49% + 15¢ | From $69/mo | Best card processor for restaurants with full POS and tip management |

| Retail Stores | Clover | Tiered / Flat | Avg 2.3% + 10¢ | From $14.95/mo | Best credit card processor for small retail needing inventory tools |

| Subscription / Membership | Stripe | Flat / Custom | 2.9% + 30¢ + billing | $0 | Best card processor for subscription billing with built-in automation |

| Nonprofits & Charities | PayPal | Nonprofit Rates | 1.99% + 49¢ (donations) | $0 | Best card processor for nonprofits accepting online donations |

| Seasonal Sellers | PayPal Zettle | Flat Rate | 2.29% (in-person) 3.49% + 49¢ (online) |

$0 | Best credit card processor for seasonal mobile payments |

| B2B / Invoicing | Helcim | Interchange-Plus | Interchange + 0.3% + 8¢ (avg) | $0 | Best transparent pricing for B2B invoicing & ACH support |

Looking to compare PayPal with a merchant account provider? Our PayPal vs. Merchant One comparison covers cost, scalability, and when each is the better fit.

ScaleUp Tip

Choosing the right payment processor is not a set-it-and-forget-it decision. As your business grows, your payment infrastructure needs to grow with it. Keep these core principles in mind to protect your bottom line in 2025:

Watch out for hidden fees: Flat-rate providers like Stripe and Square rarely charge monthly fees, but traditional merchant accounts might. Look out for hidden PCI compliance fees, statement fees, early termination fees, and expensive terminal rentals that can sneak into your contract.

Understand the volume threshold: Flat rate is best for simplicity, but it will almost certainly cost you more long term if you are processing over $10,000 a month.

Embrace wholesale pricing: Interchange-plus pricing can save serious money if your business does high volume or B2B payments. Because processors like Helcim pass the direct savings to you, you do not get penalized for accepting standard debit cards.

If your business has outgrown standard models and you need to compare wholesale options side-by-side, read our comprehensive breakdown of Helcim vs. Stax to see which subscription pricing model saves you more at scale.

Leverage ACH for large invoices: If you run a service business, credit card fees on a $5,000 invoice are painful. Look for processors that offer low-fee ACH bank transfers to keep those payments affordable.

Use this guide as a starting point, look closely at your past three months of processing statements, and then request custom quotes from providers if you are managing high transaction volumes.

FAQs

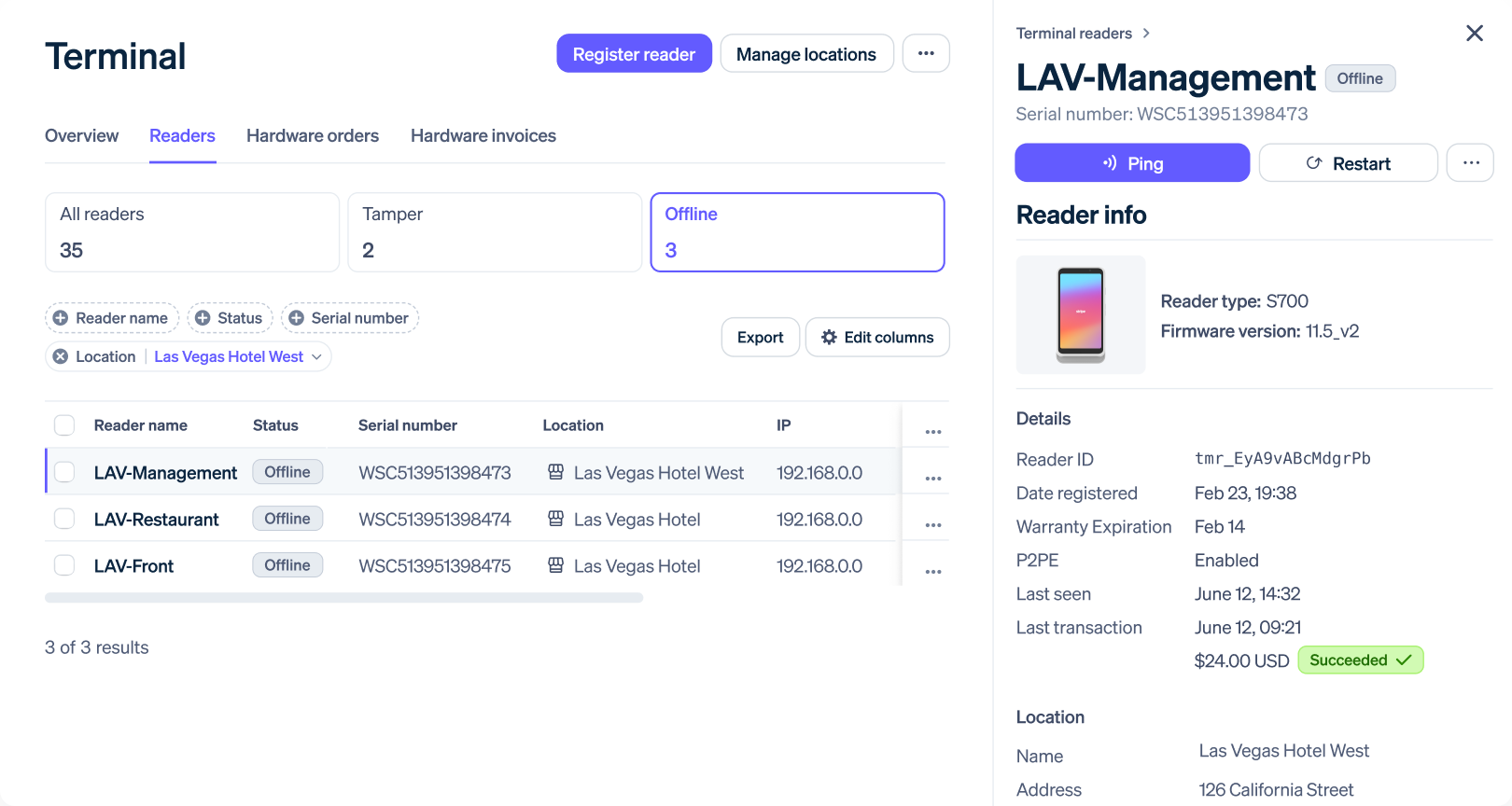

The Stripe Terminal dashboard provides real-time oversight of your physical hardware across multiple locations, allowing you to monitor device health, track firmware versions, and troubleshoot offline readers from a single centralized hub.

What is the average credit card processing fee in 2026?

Most small businesses can expect to pay between 1.5% and 3.5% of the total transaction value. The exact amount depends on your pricing model, whether the card was swiped in person or typed in online, and the specific rewards tied to the customer's credit card.

Why are online transactions more expensive than in-person transactions?

Online payments are known as Card-Not-Present (CNP) transactions. Because the merchant cannot physically verify the card or the cardholder, the card networks consider these transactions to have a higher risk of fraud. To compensate for that risk, they charge higher base interchange fees.

Is it legal to pass credit card fees onto my customers?

Yes, in most cases you can charge a credit card surcharge, but there are strict rules. Card brands cap surcharges at a maximum of 3%. Additionally, certain states have laws prohibiting surcharges, and you are never allowed to apply a surcharge to a debit card. Always check your local state laws before implementing a fee.

When should a small business switch from flat-rate to interchange-plus pricing?

A general rule of thumb is to evaluate your processor once you consistently cross $5,000 to $10,000 in monthly credit card sales. At lower volumes, the simplicity of a flat-rate provider like Square or Stripe is beneficial. As you scale, switching to an interchange-plus provider like Helcim can often save businesses up to 25% on their processing margins.