PayPal vs. Merchant One: Choosing the Right Merchant Account Provider

Selecting a merchant account provider is essential for businesses that handle card transactions. This detailed comparison between PayPal and Merchant One will help you choose the best provider tailored to your business needs.

Not sure what a merchant account is or how it differs from a credit card processor? Start with our POS System vs Credit Card Processor comparison to understand the full payment stack.

PayPal Merchant Account: Quick Overview

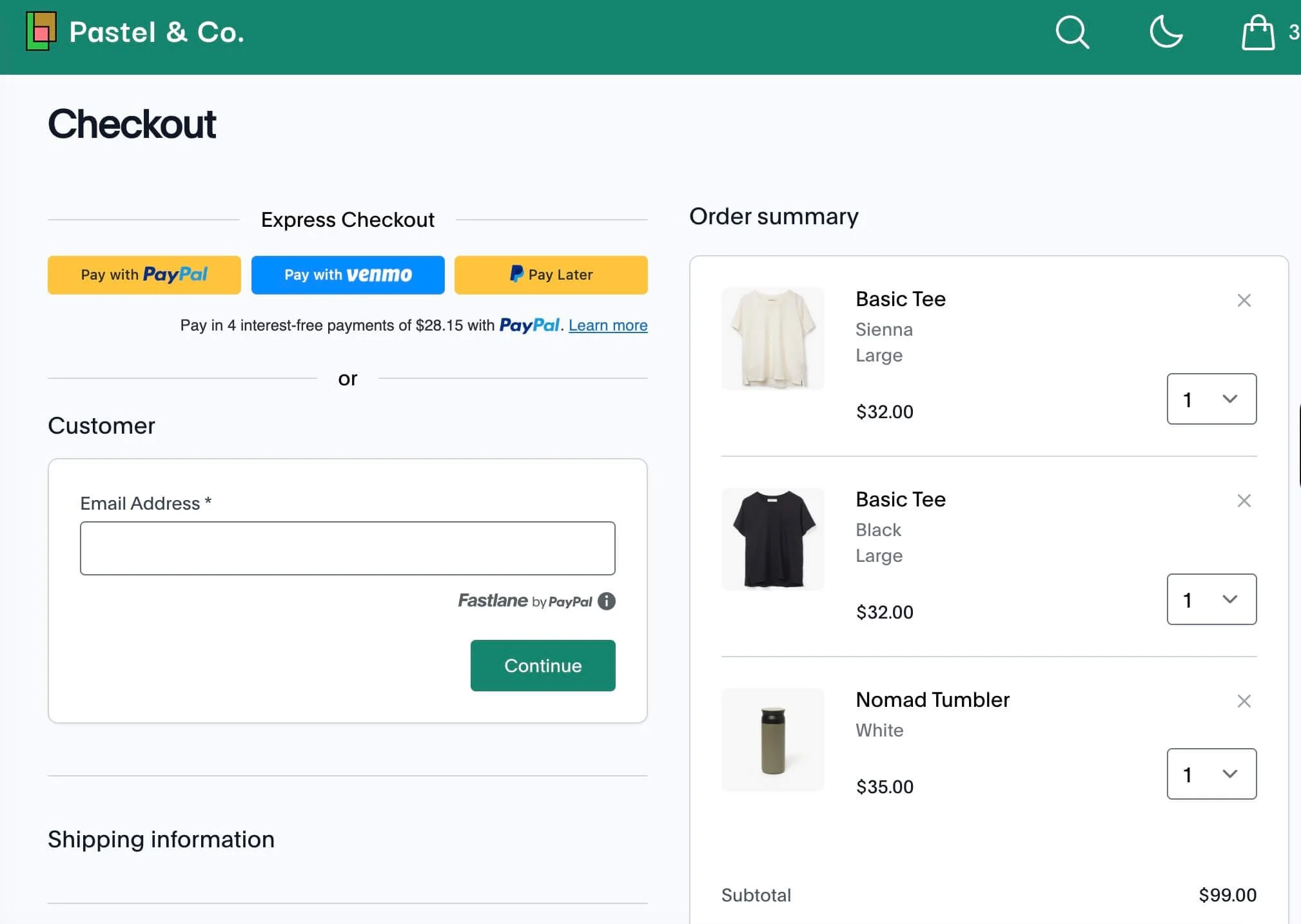

PayPal is one of the most recognized names in online payment processing, popular for its simplicity and global recognition.

Key Features:

Global brand recognition, enhancing customer trust.

Simple setup and user-friendly interface.

Seamless integration with various e-commerce platforms.

Pricing:

Flat rate of 2.9% + $0.30 per transaction.

No monthly fees for standard accounts.

Best For:

PayPal is ideal for small businesses or those heavily reliant on online transactions.

Confused by rates and hardware? Start with the ultimate guide to card payment solutions for small business.

Merchant One Account: Quick Overview

Merchant One is well-known for offering merchant accounts with robust support for both online and physical retail environments.

Key Features:

Comprehensive merchant services including online, mobile, and retail payments.

Tailored solutions for diverse business needs.

Strong customer support and fraud protection measures.

Pricing:

Custom pricing based on business volume and risk profile.

Monthly fees typically apply but vary based on service tiers.

Best For:

Merchant One suits businesses looking for tailored merchant account services and personalized support.

PayPal vs. Merchant One: Feature Comparison

| Feature | PayPal Merchant Account | Merchant One Account |

|---|---|---|

| Ideal Use Case | Small online businesses | Medium-sized and retail businesses |

| Pricing Structure | Flat-rate (2.9% + $0.30 per transaction) | Custom pricing, monthly fees vary |

| Setup Complexity | Easy, quick setup | Moderate, tailored setup |

| Customer Support | Limited, primarily online support | Robust, personalized support |

| Transaction Security | Good, with standard fraud protection | Excellent, comprehensive protection |

How to Choose: PayPal or Merchant One?

Assess your business type and transaction needs:

Small Online Businesses: PayPal offers simplicity, quick setup, and customer familiarity.

Retail and Growing Businesses: Merchant One provides customized solutions and superior customer support, ideal for higher transaction volumes and specialized needs.

Want a broader match-up? Our Credit Card Processor Comparison by Business Type: Best Features & Use Cases (2025 Guide) helps break down which providers excel across different industries and payment types.

ScaleUp Tip

Consider your customer transaction habits and future growth trajectory. PayPal’s global brand could simplify online transactions, while Merchant One might better support complex business models and higher transaction volumes. Choose a provider aligned with both current operations and future expansion goals.